-

- schizoidman

- Posts: 2

- Joined:

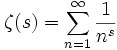

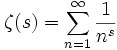

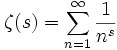

Credit spreads to survival probabilities

Hi,I've been trying to manually calculate the default probabilties on the Bloomberg CDSW screen using the JP Morgan model. It seems that the Morgan model uses a hazard-rate function of credit spreads to analytically compute the default probabilities rather than solve for them. I've managed to come close, but it's still not exactly the same as Bloomberg. I'm attaching a spreadsheet, and I was wondering if someone could give me some pointers.Going by the screenshot, it seems that the BGN rate curve is also some sort of input into the probability calculations. I was wondering if this could be my missing piece.Thanks in advance.Schiz

-

- schizoidman

- Posts: 2

- Joined:

Credit spreads to survival probabilities

Let's see if this works...I can match Bloomberg close for 40% recovery, act/360, qtr payments and very closely for 25% recovery, act/365, sa payments.

Last edited by schizoidman on April 17th, 2006, 10:00 pm, edited 1 time in total.

-

- cosmologist

- Posts: 2

- Joined:

Credit spreads to survival probabilities

Can I have the JP morgan paper,please.thanks

Credit spreads to survival probabilities

shizoidman thanks a lot!!!! a perfect excel I think!! can anyone also send the paper please!!!

Credit spreads to survival probabilities

The paper (if it's the one i'm thinking of) is on a previous thread, from memory it involved matching BBGs CDSW

Credit spreads to survival probabilities

QuoteOriginally posted by: schizoidmanLet's see if this works...I can match Bloomberg close for 40% recovery, act/360, qtr payments and very closely for 25% recovery, act/365, sa payments.Maybe what Bloomberg does is DfltProb(i) = 1-Exp[-Sprd(i) * t(i) /{ (1 - R(i)}]

-

- schizoidman

- Posts: 2

- Joined:

Credit spreads to survival probabilities

Hi,Actually I wasn't working with the JPM paper in mind, but just trying to work backwards by matching Excel with Bloomberg. If someone does find the paper, please post it on File Share.If I remember correctly, I had read a Lehman paper that had said that survival probs are not analytically calculated, but rare solved using the single-name CDS pricer. However, it does look like Bloomberg calculates an analytical solution.

Credit spreads to survival probabilities

My dearest cosmologist,QuoteOriginally posted by: cosmologistCan I have the JP morgan paper,please.thanksI would like to read that paper also. Could you do me a favor to post it on the forum?Still, I am chasing after you, my pal!Tunito the Maverick

-

- NoelWatson

- Posts: 1

- Joined:

Credit spreads to survival probabilities

schizoidman,I've had a quick look at this and I think there are two things that are missing1). Interest rates definitely affect the default prob2). Changing a spread affects all subsequent spreads i.e if you change a 3 year spread, the default prob for 5 year and up change.RegardsNoel

-

- Sgaragnaus

- Posts: 0

- Joined:

Credit spreads to survival probabilities

schizoidman,i think you should use a time dependent hazard rate function in order to try to replicate the Bloomberg results.If you choose a piecewise constant hazard rate the survival probability will be S(t) = exp(-\sum_i {h_i * Dt_i})where h_i is the constant hazard rate value for the i-th interval and Dt_i = t_i - t_i-1 is the i_th time interval in wich the hazard rate is constant (the last interval in the summation is Dt_n = t - t_n-1).You can think at t_i as the i-th CDS maturity, so that if you have k CDS market spreads you will have k time intervals (t_0 is the valuation date). With a piecewise constant hazard rate you have to use a bootstapping procedure starting from the shortest CDS maturity and moving to the longer ones step by step.In each step you have to solve for the h_i numerically (keeping h_1,...,h_i-1 constant), by imposing the equivalence of the premium leg and the default leg for each market CDS.

-

- allenishands

- Posts: 1

- Joined:

Credit spreads to survival probabilities

How about this.Here is my model which calculates default probabilities from CDS spreads.The default probabilities are also affected by recovery rate and interest rate.

- Attachments

-

ModelvsMarketDP.zip

ModelvsMarketDP.zip- (180.56 KiB) Downloaded 91 times

Last edited by allenishands on May 14th, 2006, 10:00 pm, edited 1 time in total.

-

- Oleg

Credit spreads to survival probabilities

Hi allenishands,you mentioned that default probabilities are affected by interest rate.Assuming the DP is unchanged, can one estimate how the change of interest rate affects the spread?

-

- allenishands

- Posts: 1

- Joined:

Credit spreads to survival probabilities

Hi Oleq.Yes, it is possible to do that in the formula of my model.But I didn't do that since that is not my main point of my thesis.

Credit spreads to survival probabilities

Hello Allenishands,I tried to get the same results as CDSW some time ago.I put my results in your spreadsheet.Does your computation take long time ?Would it be possible to read your thesis ?Thank you.HPB

- Attachments

-

ModelvsMarketDP_MINE.zip

ModelvsMarketDP_MINE.zip- (180.8 KiB) Downloaded 79 times