GM CDS Spreads - How can they be 180% ?

Does anyone know why/how General Motors CDS spreads (1 year) are quoted at 190% (upfront plus 500bps running) ? Not sure how it makes sense - why pay 190% to get back 100% on default ?

GM CDS Spreads - How can they be 180% ?

Risk Neutral market suggesting the company will not last more than 6mths?

GM CDS Spreads - How can they be 180% ?

QuoteOriginally posted by: pawlmiDoes anyone know why/how General Motors CDS spreads (1 year) are quoted at 190% (upfront plus 500bps running) ? Not sure how it makes sense - why pay 190% to get back 100% on default ?maybe it's 19% upfront and not 190%... 190% wouldn't make any sense!Isn't it 1900 bps (upfront)?

-

- Traden4Alpha

- Posts: 3300

- Joined:

GM CDS Spreads - How can they be 180% ?

I'd bet it's much higher than 19% upfront right now (it was 80% upfront on Dec 5 before Congress pulled the plug, see: reuters.com )

Last edited by Traden4Alpha on December 17th, 2008, 11:00 pm, edited 1 time in total.

GM CDS Spreads - How can they be 180% ?

QuoteOriginally posted by: Traden4AlphaI'd bet it's much higher than 19% upfront right now (it was 80% upfront on Dec 5 before Congress pulled the plug, see: reuters.com )ok. 80% makes sense. I just can't get how it could be 190%.In case of default you pay Notional*(100%-RecoveryRate). If RR=0 then you have a loss of 100%. If one receives 190% upfront no matter when the default happens one will have a +90% profit. 190% upfront is a free-lunch. Am I missing something?

GM CDS Spreads - How can they be 180% ?

It could be that the upfront quote was mapped into an equivalent running spread, think this happens once in a while internally here. Ie, on a running basis i am promised 190%. However, if i think that GM will only last, say, 1 month, I only accrue 15% coupons. Suppose the duration of the CDS was 0.2 yr, upfront would be around 38% of notional, thus pricing in 100% risk of deafult with a recovery of 62%.

GM CDS Spreads - How can they be 180% ?

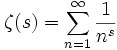

Here's the CDS curve for GM - note the spread for 1 year. As Bullbear says, it doesn't make sense ?

- Attachments

-

Word docs.zip

Word docs.zip- (23.85 KiB) Downloaded 70 times

GM CDS Spreads - How can they be 180% ?

Re my post above, it does indeed look like they quote "equivalent" running spread which you have to convert to equivalent upfront quotes if you want any hope of finding someone to trade with. So it does make sense what they quote, it is just a matter of convention

GM CDS Spreads - How can they be 180% ?

QuoteOriginally posted by: pawlmiHere's the CDS curve for GM - note the spread for 1 year. As Bullbear says, it doesn't make sense ?This surely looks like a running spread.

-

- freddiemac

- Posts: 7

- Joined:

GM CDS Spreads - How can they be 180% ?

also when quoting an equivalent running spread you need to assume a recovery rate. sometimes people just assume 40 % and then translate the upfront payment to equivalent running spread. For names like GM that trades with very high points upfront (around 80% + 500bp running I think for 5Y, at least before the government loan). If the name trades at 80 % then the market does not believe recovery will be 40 % (the market assues about max 20 % recovery since 100-80=20). sometimes when people use recovery rates that are clearly wrong that can cause the running spread to be too high or too low. always be careful when looking at equivalent spreads!

-

- schizoidman

- Posts: 2

- Joined:

GM CDS Spreads - How can they be 180% ?

Hi pawlmi,I think you might be thinking about this problem the wrong way round. Upfront is exchanged at the beginning of the trade, so it's effectively cash in the bank. In this context, your original argument is absolutely correct. It wouldn't make any economic sense to enter into a trade that requires a 100% upfront.Running premium on the other hand is not exchanged up front, but is a regular coupon the buyer pays the seller contingent on the reference credit not defaulting. So the 190% coupon that you refer to is unrealized.If you think about the swap in terms of duration and upfront it might be slightly more clear. The duration at the 6M point (19000bps) is approximately 0.3 and at the 10Y point (9000bps) is 0.65. Converting this running back into an upfront gives us an equivalent upfront of 53% at the 6M point, and 58% at the 10Y point.These par fees give you an idea about implied recovery and make a bit more common sense that the inverted spread curve.Regards,Schiz

GM CDS Spreads - How can they be 180% ?

Schizoidman - cheers, that's really helpful and it finally makes sense to me - thanks to everyone else too who contributed. It does seem to be a running spread rather than up-front, my mistake.