-

- schizoidman

- Posts: 2

- Joined:

What is the difference between a bond and a loan?

In terms of cashflows and in terms of pricing?Thank you.

-

- SierpinskyJanitor

- Posts: 1

- Joined:

What is the difference between a bond and a loan?

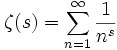

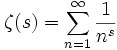

exactly the same as in both terms of the ZETA function in your avatar: None.

-

- Traden4Alpha

- Posts: 3300

- Joined:

What is the difference between a bond and a loan?

The cashflows can be the same although loans can have more idiosyncratic cashflow structures. The only difference in pricing is in the value of the optionality the bond's liquidity in a secondary market.

What is the difference between a bond and a loan?

There are obviously a lot of variations, but typical syndicated term loans have maturities of 5-7 years, pay interest at Libor plus a spread, are freely prepayable at par following a short period (say 1 year) where some prepayment penalty is in effect, and very often has embedded a floor on the Libor resets (100-150 bps is common in recent issues). Bonds, in comparison, tend to be issued at 10 or 30 year maturities, paying interest at a fixed rate, and usually not callable for most of their life. Because the loans come with stronger covenants than bonds as well as a security package, we usually assume significantly higher recovery rates on them in case of default (say 75% rather than 40%). It is probably also worth pointing out that syndicated loans are not securities, and that the process of "trading" them is a bit more gnarly than trading bonds (the loan market is one of the last vestiges of fax machines - remember them?).

-

- schizoidman

- Posts: 2

- Joined:

What is the difference between a bond and a loan?

Thanks for all the replies. What exactly is a syndicated loan?